Case Studies

At CrowdThnk, we believe market positioning is one of the most important factors in driving future price movements. These are a few historical case studies in which our positioning data helped to identify profitable trading opportunities, giving our clients a competitive edge in the stock market.

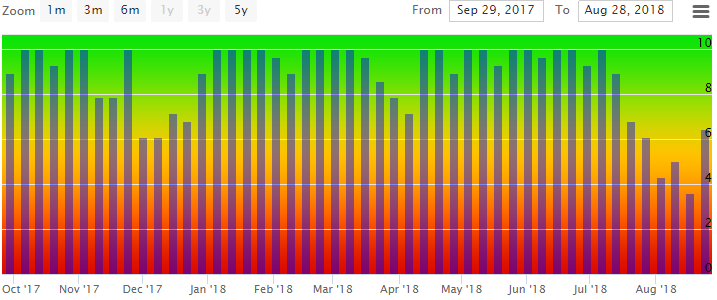

Case #1 – Tesla (TSLA)

- Positioning oscillated significantly between extremes over the past year

- Historical Patterns suggest a high probability of Mean Reversion when Positioning reaches extremes in this stock

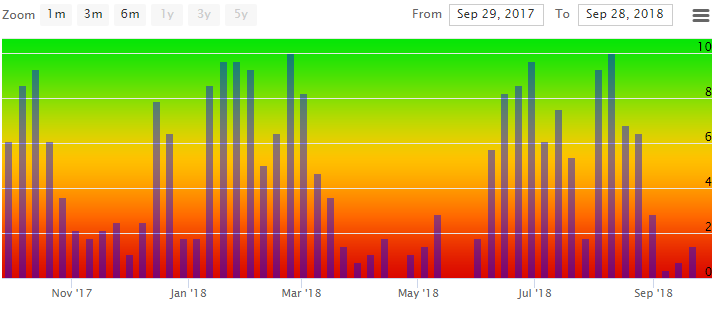

Case #2 – Amazon (AMZN)

- Long periods of heavily overweight positioning new 9-10 levels

- As a momentum stock, stock price keeps heading higher as strong positioning induces more inflows and conviction

- Historical patterns suggest overweight positioning begets more buying for Momentum stocks

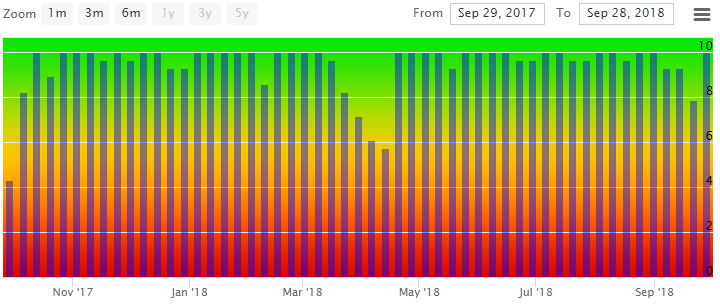

Case #3 – Netflix (NFLX)

- Elevated and positioning ahead of July 2018 earnings announcement

- Clients hedged and adjusted portfolio by being cognizant of oversubscribed positioning and skewed risk-reward on the event